Zero-Carbon Fuels Set to Transform the Future of Shipping

In 2018, the International Maritime Organization (IMO), a specialized agency of the United Nations that internationally regulates shipping, adopted an initial greenhouse gas (GHG) strategy, targeting a minimum 50% reduction of total GHG emissions from international shipping by 2050, compared to 2008 levels.

On June 15, 2021, the IMO decided to bring the implementation date of this strategy forward by three years. That now means certain vessel types built from 2022 onwards, including gas carriers and general cargo ships, must be significantly more energy efficient. This presents a major challenge for a sector that has depended on fossil fuels for decades, so there are a range of zero-carbon fuel options currently under research and development by the shipping industry.

Proposed green marine fuels ammonia and hydrogen are very promising as they offer a balance of favorable lifecycle GHG emissions and economics, as well as technical and safety implications for vessels and owners, according to the World Bank.

Also, biofuels and synthetic carbon-based bunker fuels demonstrate high technical potential for use, but limited feedstock availability to produce these types of fuels may be a stumbling block to guaranteeing large-scale, regular supply.

Shipowners and shipping industry analysts do expect green ammonia to play a key role in the future development of marine fuels, but there are two crucial caveats: production is still on a small scale and most commercial shipping isn’t currently equipped to use it as fuel.

Green ammonia is produced through a process that emits zero or minimal carbon dioxide (CO2) and other greenhouse gases into the environment. This technology is however still in the early stages. It is environmentally quite opposite to the conventional ammonia technologies that, depending on the type of carbon-bearing fossil material used to make ammonia, generate 1.5-2.5 metric tons of CO2 for every 1 metric ton of ammonia produced, according to data from IHS Markit.

Currently, around 80% of ammonia produced is used in the manufacture of fertilizers. Global production of ammonia is expected to expand to nearly 290 million mt/year by 2030 from around 180 million mt/year in 2021, according to a recent policy briefing entitled Ammonia: zero-carbon fertilizer, fuel and energy store by The Royal Society.

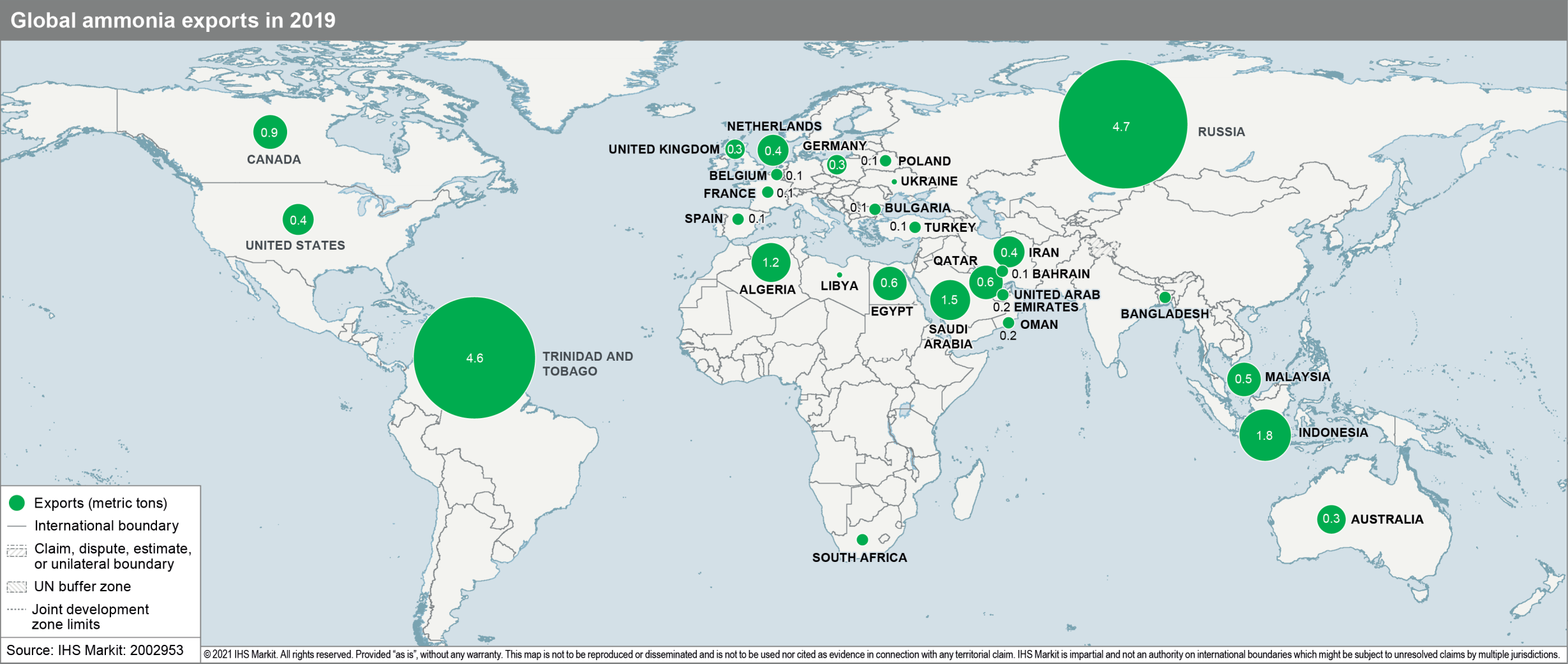

The port and shipping infrastructure that is already in place for the large-scale transportation of ammonia could enable the early adoption of ammonia as a shipping fuel.

“By 2050, we expect green ammonia and bio-methanol to end up with a strong share of the market; so they are currently the most promising carbon-neutral fuels in the long run,” said Hendrik Brinks, principal researcher of zero-carbon fuels at Norwegian shipping classification society DNV Maritime. “However, if 30% of shipping switched to ammonia as a fuel, then current production would have to nearly double,” Brinks said.

“Our models suggest that fossil LNG will be prominent until regulations tighten around 2030. Bio-MGO, e-MGO, bio-LNG and e-LNG might emerge as drop-in fuels for existing ships,” DNV Maritime analysts said in the DNV Maritime Forecast to 2050 report.

Vessel type and trading patterns are key

Meanwhile, different vessels have different fuel requirements, according to Magnus Jordahl at DNV Maritime. Ferries can potentially run entirely on batteries for shorter routes, but these would not be suitable for long-haul voyages. Hydrogen is also being considered as a potential fuel for short-haul journeys, while ammonia could be an option in deep sea shipping. Commercial viability is heavily dependent on the business case for these fuels and needs to take into account the vessel type and individual trading pattern, said Jordahl.

Lower CO2 emissions are the hottest topic in the market and some of the recently ordered ships are estimated to be cutting carbon output by nearly 40% compared to units built in 2010.

On June 2, the Nordic Green Ammonia-Powered Ship (NoGAPS) consortium, developed by the Global Maritime Forum and Fuerstenberg Maritime Advisory, launched their study, revealing a promising outlook for green ammonia-powered vessels.

“Our study finds that using green ammonia as a fuel is both practical and feasible,” said Jesse Fahnestock, project director at the Global Maritime Forum. “The focus should now be on measures that can strengthen the business case for zero-emission ammonia.”

The use of ammonia as a fuel has made rapid progress over the past few years, and the maritime industry is a major driver of this development. But it comes with its own challenges, according to a recent study from IHS Markit, the parent company of OPIS.

Ships using ammonia as fuel will need much larger fuel tanks, according to Julia Wainwright, a senior research analyst at IHS Markit. Also, the toxicity of ammonia makes it less viable for passenger ships and creates potential obstacles at existing port facilities, said Wainwright.

Ammonia maintains a liquid state either at minus 33.6 degree Celsius and 1 bar, or 8.6 bar and 20 degrees Celsius. Industrial scale storage uses low temperatures, which requires energy to maintain. This option may have a lower capital cost than pressurization in some cases, due to the lower storage design pressures, according to a sustainability whitepaper published last October by ABS. Ammonia requires more than twice the amount of tank volume of heavy fuel oil for generating the same energy, according to the “Ammonia as Marine Fuel” whitepaper.

Marine engine research drives the development of green shipping

The combined influence of shipowners with large fleets, the modern shipyards in China, South Korea and Japan, as well as the latest designs in marine engines are all driving the development of zero carbon, green shipping fuel.

For example, MAN Energy Solutions, a designer and manufacturer of marine engines, is developing an ammonia fueled-engine based on current liquid natural gas technology and anticipates the first ammonia engine could be in operation by early 2022, according to the Royal Society report.

Also, Lloyd’s Register has approved the design of a 180,000-mt ammonia-fuelled bulk carrier from the Shanghai Merchant Ship Design and Research Institute. Lloyd’s has also announced a project for an ammonia-fuelled 23,000 TEU ultra-large container ship concept design from MAN and the Dalian Shipbuilding Industry Company.

And oil tanker companies are getting involved. Belgium’s Euronav, one of the biggest tanker owners in the world, said in April it had ordered up to three Very Large Crude Carriers (VLCCs) that can use ammonia, as well as liquefied natural gas (LNG) as marine fuel, as shippers gear up to reduce carbon emissions over the next decade.

Euronav’s VLCCs will be ready to use LNG and ammonia when the technology is available and regulatory frameworks are in place. The vessels will be built at South Korea’s Hyundai Samho shipyard. Euronav is the first shipping company to order ammonia-ready VLCCs, according to IHS Markit analysts.

“The shipbuilding industry is experiencing a new wave of green orders placed by major shipping companies,” said IHS Markit principal analyst Fotios Katsoulas. “Lower CO2 emissions are the hottest topic in the market and some of the recently ordered ships are estimated to be cutting carbon output by nearly 40% compared to units built in 2010.”

But so far, there is no silver bullet to solve the zero-carbon fuel conundrum for shipping.

“LNG won’t be the [only] marine fuel to meet the 2050 target,” said Katsoulas. “Hydrogen, ammonia and other low-emission fuels are more efficient in the long run.”

For daily marine fuel pricing assessments, be sure to check out our Global Marine Fuels Report for key cargo and bunker fuel prices, news and commentary for Asia, Europe and the Americas.