Year-on-Year Fuel Disinflation Likely to Reach Epic Proportions

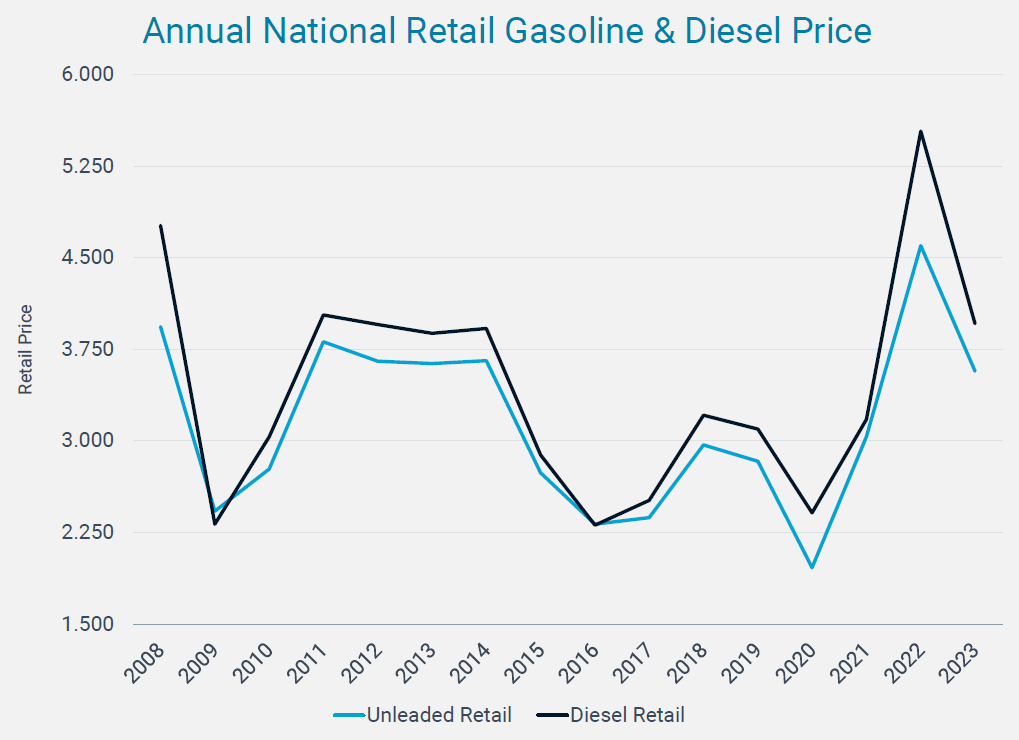

Thanks to irrational exuberance on the part of oil speculators in the spring of 2022, comparisons for key fuels in the U.S. are now spectacularly striking.

For example, one can predict with reasonable certainty that June will feature average diesel fuel prices in coming days that are at least $1.50/gal lower than on the same days of the calendar in 2022. And even with some modest increases in gasoline on the horizon, average motor fuel prices in the next portion of the driving season could be $1.25-$1.50/gal beneath year-ago levels.

Diesel fuel averages first topped $5/gal way back on March 10, 2022, and then rode considerably higher last April and May on the mistaken assumption that Russian diesel would not make it to world markets.

On April 29, 2022, the U.S. average diesel price eclipsed $5.18/gal on its way to an eventual top of

$5.8159/gal on June 19, 2022.

On the morning of May 26, 2023, OPIS calculated an average U.S. price of just $3.962/gal, and diesel margins remain quite robust at more than 68cts/gal. One doesn’t need to have the predictive skills of Nostradamus to assume the trend toward price decreases could continue into June. On June 1, 2022, the average diesel price was $5.5383/gal so numbers at least $1.50/gal lower amount to statistical layups.

Widest Gap of the Century

The widening gap evokes some other odd statistical relationships in the century. The widest disparity between then-current and year-ago diesel prices occurred on July 18, 2009. The country was then in the final throes of the Great Recession with a diesel price average of just $2.5421/gal. On July 18, 2008, the U.S. diesel average was $4.8424/gal, reflecting a difference of $2.30/gal.

The widening gap evokes some other odd statistical relationships in the century. The widest disparity between then-current and year-ago diesel prices occurred on July 18, 2009. The country was then in the final throes of the Great Recession with a diesel price average of just $2.5421/gal. On July 18, 2008, the U.S. diesel average was $4.8424/gal, reflecting a difference of $2.30/gal.

It is quite possible that the remainder of the second quarter of 2023 will see fuel prices remain $1/gal to more than $1.50/gal below year ago levels. The OPIS historical database finds June and July 2022 averages of $4.921/gal and $4.548/gal for gasoline with diesel at $5.744/gal and $5.548/gal. Only a black swan event could dictate that energy disinflation isn’t staggering over the next two months.

Other than in the Great Recession, yearly disinflation of $1/gal or more occurred only in early 2015. Thanks to a rancorous November 2014 OPEC meeting, the first five months of 2015 all saw diesel averages at least $1/gal below the same months in 2014.

Disinflation in Jet Fuel

If you are looking to pick the poster child for disinflation, you’d do well to look at jet fuel

comparisons. May 2022 saw some insanely high numbers for 54 grade jet fuel. New York Harbor was short on supply and recorded an average price of $5.39/gal, with occasional visits above $7/gal on some wild days.

There were numerous days in the spring of 2022 where jet fuel costs mimicked the numbers of Boeing aircraft. On the morning of May 26, 2023, jet fuel was fetching prices that ranged from $2.22/gal at the US Gulf Coast to $2.45/gal in the Pacific Northwest, reflecting numbers that have declined by well over 50% on a year-over-year basis.

What Could the Rest of 2023 Bring?

If disinflation disappears for gasoline, it would most likely do so in the third calendar quarter. Hurricane season brings special risks. US refining capacity is significantly higher these days than in 2005 when Hurricane Katrina wreaked havoc, and the country boasts about 1.5 million b/d more refining capability in the states of Alabama, Louisiana, Mississippi, and Texas. Probability cones in the Gulf of Mexico could lead to gasoline prices that top the August and September 2022 averages of $3.9723/gal and $3.733/gal.