$2 Billion Global Voluntary Market Leaves Europe in its Wake

The global voluntary carbon market (VCM) is soaring after hitting a transaction value of nearly $2 billion in 2021, while Europe remains a relative backwater, providing just a small fraction of the world’s carbon offset credits.

Just 1 million metric tons of carbon dioxide equivalent (CO2) were reduced by European VCM projects in 2021, compared to 90 million tons of CO2 removals in Asia, according to environmental data provider Ecosystem Marketplace (EM) data. By contrast, the global VCM is expected to be worth a whopping $30 billion by 2030, according to EM forecasts.

Furthermore, there is skepticism in Europe at the highest levels of government about the potential benefits of carbon credits, with political energy more focused on cutting emissions by industrial installations through the European Union’s Emissions Trading System (ETS).

During the 2020s, the EU ETS aims to almost halve the carbon emitted by those 10,000 stationary installations that currently produce more than 1.5 billion mt/year of carbon dioxide, making the potential carbon dioxide reductions from VCM projects pale by comparison.

In a series of blog posts over the next few months, OPIS will examine the prospects for the voluntary carbon market in Europe and ask whether carbon credit projects across the continent will ever make a meaningful contribution to the market.

The state of the VCM

The voluntary carbon market started as an initiative for private individuals, corporations and other actors, to buy and sell carbon credits beyond the scope of regulated carbon compliance pricing instruments.

A carbon credit is a tradable unit and equals one ton of greenhouse gas (GHG) emissions reduction or removal. Within the VCM system, credits can be generated via nature-based or technology-based projects; their prices depend on eight different VCM categories.

According to Ecosystem Marketplace, more than 170 project-specific types were traded globally over 2020-2021, with forestry and land use accounting for 46% of traded volumes in 2021, up from 28% in 2020.

WSJ Climate & Energy

Get news, analysis and exclusive data on climate and business, free in your inbox every week.

Sign up for the WSJ Climate & Energy newsletter, with insights from across Dow Jones, including WSJ, OPIS, Barron’s, MarketWatch and IBD.

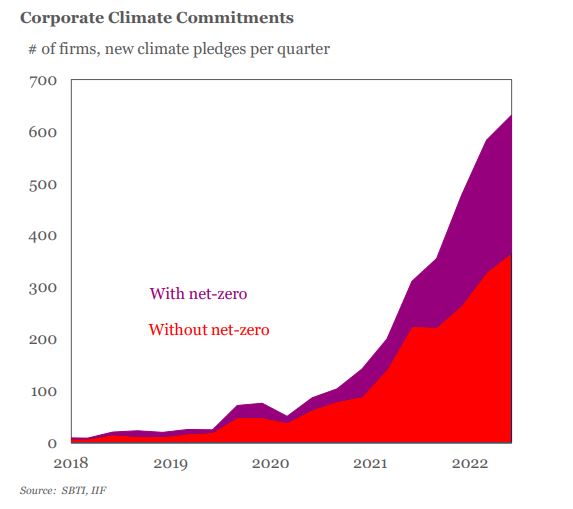

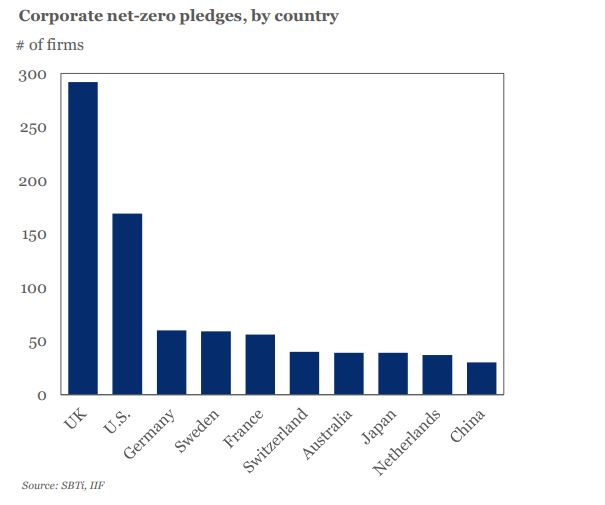

Companies globally are seeing increased demand from business partners and clients to decarbonize; reducing value chain emissions and using VCM carbon credits seems a good and cheap way to achieve their net-zero goals.

“Carbon is no longer a public relations tool; it has instead become an element in competitiveness and procurement processes,” Malwina Burzec, senior associate and attorney-at-law specializing in sustainability at consultancy EY, told OPIS.

Globally, heavy industries and hard-to-abate sectors are keen to buy offset credits, which help to reduce their net emissions at a price somewhere between $5-15/metric ton of CO2 (mtCO2). By contrast, payments for emissions allowances subject to European compliance markets currently cost around $80/mtCO2.

Critics of the system however say that this could be a snag: “cheap offsets” can be used to avoid the hard work of cutting emissions, while the quality and transparency of carbon offset projects in which companies invest can be ill-defined and poorly regulated.

In April 2021, researchers at the nonprofit group CarbonPlan discovered that some $410 million worth of offsets had been sold under the California forest carbon offsets program without absorbing a single ton of carbon dioxide.

Similarly, Finnish nonprofit and impact startup Compensate calculated that 90% of evaluated projects include serious permanence risks and unreliable baselines, while the assumed scale of deforestation that would take place in the absence of those offset projects was largely inflated. More worryingly still is that many offset projects cause serious human rights violations, Compensate said in its Reforming the Voluntary Carbon Market 2021 report.

While financial markets are overseen by government regulators like the U.S. Securities and Exchange Commission, businesses, brokers and traders dealing in VCM projects are yet to be regulated. At best, they are largely shaped by broader national environmental and decarbonization policies.

For Mark Lewis, head of climate research at Andurand Capital Management, the VCM market has always been less transparent and complicated, and it is the role of regulators to provide the methodologies needed.

“Today the range of [methodologies] is so broad that the impact of price discovery and information is crucial. Finance service providers could be mediators, linking and matching buyers’ and sellers’ criteria and helping buyers to achieve their goals,” he said at a recent event organized by the International Emissions Trading Association.

The state of the European VCM

“Europe is a well-developed region, and there is less potential for nature-based offset projects than you would have in developing countries,” said EY’s Burzec.

Government subsidy systems also limit the need for VCM projects, Burzec suggested: “Additionally, Europe offers a broad scope of public aid and regulatory requirements to stimulate renewable and energy efficiency projects.”

“At VCM, project developers must prove that the project is additional, that financing from carbon credits is inevitable for project deployment, and that there are significant barriers to implement the project,” she added.

A lack of clarity about the rules governing carbon offset credits has also stymied projects in countries with ample land resources.

“In Finland there is a very lively discussion going on, as companies would like to invest in local projects, lots of them in forestry and some also in technical removals, while trying to avoid double claiming with the Finnish targets,” Hanna-Mari Ahonen, an analyst at Germany-based climate consultancy Perspectives, told OPIS.

“Credible voluntary offsetting should be based on emission reductions or removals that are not also claimed by the host country,” she said. “The current EU legislation is not up to date yet and does not seem to enable individual EU countries to give up their claims to certain emission reductions or removals.”

The Finnish government has commissioned studies on regulating voluntary carbon markets and avoiding double claiming. Best practice guidance has also been developed at the Nordic level.

In the meantime, financial markets are paying increased attention to the VCM market, trying to find out their role in it and what kind of services they can provide.

Market participants have called on European lawmakers to merge the EU compliance and voluntary carbon market systems, as they seek to achieve harmonization of national accounting practices with increased VCM transparency.

Benchmark pricing solutions for voluntary carbon markets are now available with the OPIS Global Carbon Offsets Report. Manage your carbon neutrality commitments with access to compliance and voluntary offsets markets pricing, real-time news and in-depth analysis.