OPIS Carbon Neutral Fuels Index Reveals Suppliers’ Cost to Offset Emissions

From extraction to distribution, the pressure is on for the oil and gas industry to cut carbon emissions, and corporate net-zero ambitions have expanded much faster than the global energy transition.

While that transition has begun, it’s clear to industry stakeholders that emission reductions cannot wait for the world to retool with new technology.

This conundrum has inspired companies to seek alternative solutions such as offsetting the emissions from fossil fuels to create carbon-neutral shipments and products.

For many, the keys to access a new net-zero strategy were found all over the world — in the depths of the Amazon rainforest, a landfill in India or at a wind farm in China.

From reforestation to waste-to-energy to fuel-switching, climate projects have rapidly injected carbon offset credits into the fast-growing voluntary carbon market. There, corporations found a selection of seemingly unlimited types of credits to offset the emissions from refined products and shipments – unlocking a carbon-neutral strategy that has only grown in popularity as companies pursue green optionality for customers.

These players are now embedded in the voluntary carbon market – actually helping to propel its growth to more than $1 billion last year as the carbon abatement tactic spread across fuels sectors and the supply chain.

Yet, because of the complexities around carbon credit price and quality – due to an abundance of project types – uncertainty remained about how to fairly and competitively expand portfolios to include more carbon-neutral product offerings.

For the first time ever, the OPIS new daily Carbon Neutral Fuels Index (CNFI) brings transparency to the cost of offsetting fuel’s emissions, offering a solution to streamline credit quality decisions.

Leveraging its legacy fuels markets and leading carbon market expertise, OPIS created the new benchmark using its long-standing and widely used California Cap-at-the-Rack (CAR) pricing benchmark as a template.

For CAR, the emissions reduction price for various transportation fuels is determined by taking into consideration the specific fuel’s CO2e value (a measure of global warming potential) and the OPIS’ daily California Carbon Allowances (OPIS CCA) secondary market assessment. CCA is the compliance carbon credit for the California Cap-and-Trade Program.

The CAR price has been used for nearly a decade by California fuel suppliers to recover the costs associated with complying with the cap-and-trade program on wholesale fuel invoices. These costs may be displayed as a line item or embedded into the total cost.

When an industry need arrived to quantify emission reduction costs for fuels on a voluntary level, OPIS conceptualized an index for the global fuels and shipping industries.

The OPIS CNFI includes the emissions offsetting price for 18 standard liquids and gaseous fuels, as well as the eight International Maritime Organization’s (IMO) shipping fuels, using OPIS-derived carbon dioxide equivalent (CO2e) emissions factors from regulatory agencies.

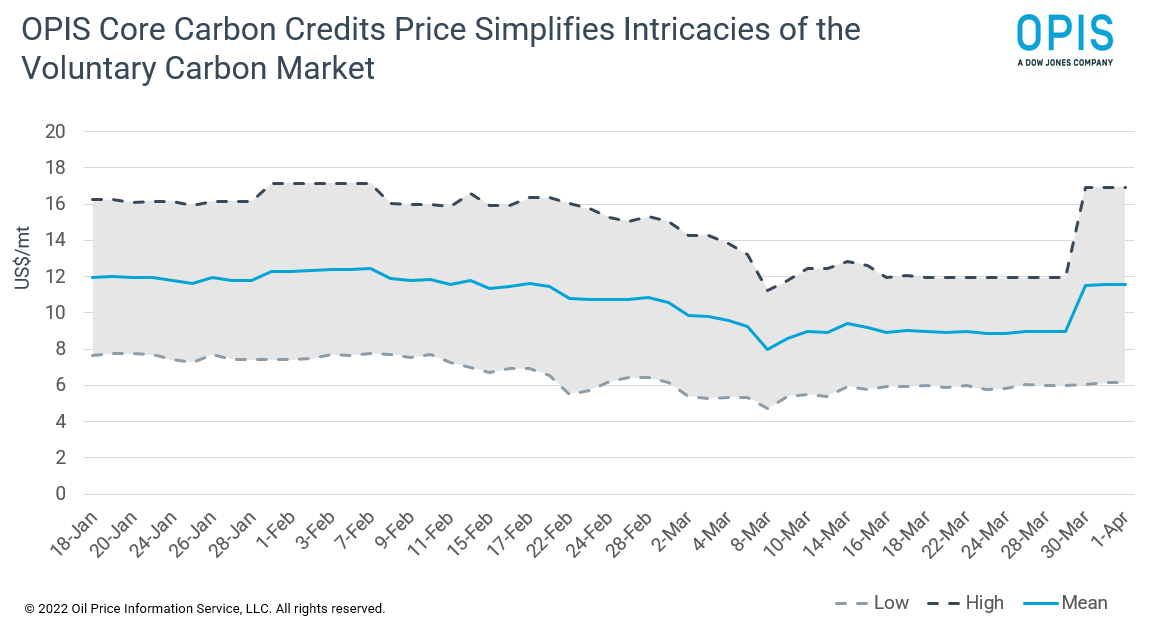

That emissions factor is vital to the CNFI formula, which also includes the daily OPIS Core Carbon Credits (CCP) assessment – a price that simplifies the intricacies of carbon credit type and price.

The OPIS CCP provides a single price for standard carbon credits trading in the voluntary carbon market. That price is reflective of the cost for offsets in the two most liquid voluntary carbon trading markets in the world — CORIA-eligible offsets and REDD+, as well as other agriculture, forestry, and land use (AFLOU) credits.

Credits that are eligible for use under the Carbon Offsetting and Reduction Scheme for International Aviation are widely considered to be standard quality because compliance with the program’s methodology places limitation on vintage year. Meanwhile, Reducing Emissions for Deforestation and forest Degradation credits, which often come from projects with additional societal benefits, are perceived to be high-quality. (Read more on carbon credit differences here.)

Sourcing carbon credits within the scope of the OPIS CCP limits quality risk while also preserving optionality for purchasing decisions between lower cost and higher cost markets.

On March 28, the OPIS CCP average price was $8.965/mt, with a low of $5.98/mt and a high of $11.95/mt.

Including that CCP average price, OPIS CNFI mean prices ranged from a low of $12.325/mt for IMO Methanol to a high of $28.96/mt for Gas Oil. Those prices represent the additional cost for achieving carbon neutrality by retiring carbon credits for fuel supplied at its benchmark price.

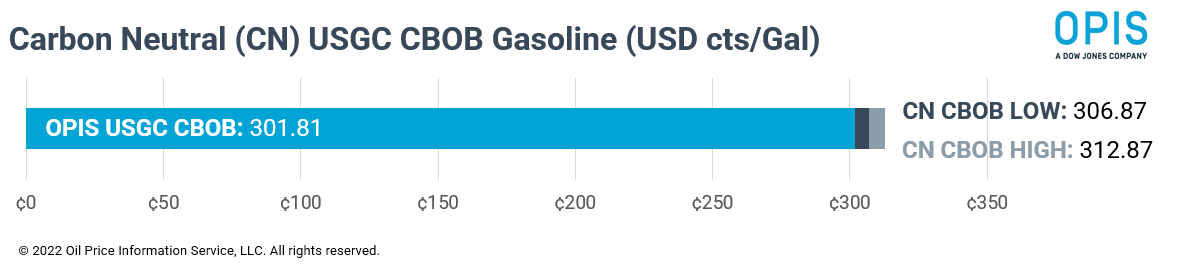

For example, the CNFI Gasoline range was a low of 5cts/gal and a high of 11cts/gal, with a mean of 8cts/gal. This is based on the derived OPIS CNFI Gasoline CO2e value of 0.00881 mt/gal and the daily OPIS CCP assessment. On the same day, the prompt OPIS US Gulf Coast Reg. CBOB assessment average was 301.87cts/gal. The total cost to achieve carbon neutral USGC gasoline with the retirement of carbon credits can be priced at a range of 306.87-312.87cts/gal.

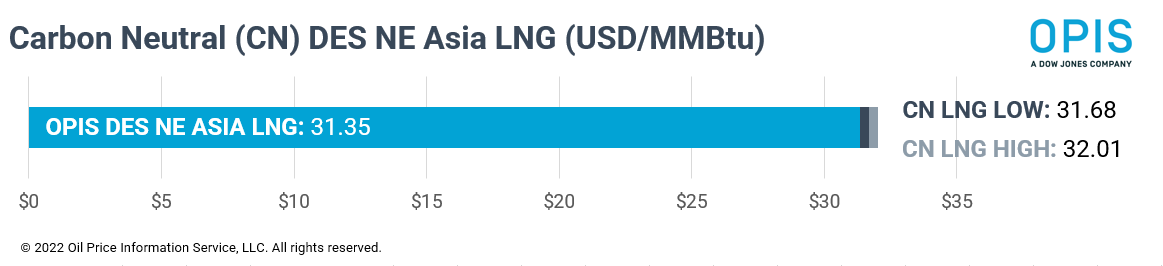

Looking at LNG, the average cost to attain carbon neutrality through offsetting was $0.495/MMBtu, based on an OPIS CNFI LNG range of $0.33-$0.66/MMBtu. OPIS assessed DES Northeast Asia LNG prices for May delivery at $31.35/MMBtu. Taking these assessments into account, the total cost to achieve carbon-neutral LNG was a range of $31.68-$32.01/MMBtu. On a larger scale, this equates to around $111.5 million for a carbon-neutral LNG cargo.

The CNFI and CCP price assessments are published to the daily OPIS Global Carbon Offsets Report, which launched in December 2020 to meet the demand for benchmark pricing for voluntary carbon markets. The OPIS Global Carbon Offsets Report along with the daily OPIS Carbon Market Report provide the largest compliance and voluntary carbon market price suite by any price reporting agency in the world. OPIS’s robust and comprehensive coverage of the carbon markets enables global project developers, traders, marketers and investors to accurately identify a fair value for their assets and understand compliance costs associated with carbon and emissions programs.

OPIS carbon assessments reflect confirmed bids, offers and trades reported by approved traders, brokers and electronic platforms. Full details about the OPIS voluntary and compliance carbon methodologies can be found in OPIS Carbon Market Pricing.