How OPIS Assesses New York Harbor Spot Fuel Prices

Gasoline, diesel and jet fuel trade in the New York Harbor spot market on a full-day basis, with price swings having a direct impact on wholesale and retail pricing throughout the Northeast.

OPIS recently hosted a free webinar to give you a 360-degree, in-depth look at the New York Harbor market so you can see how it trades, how we cover it and why it matters. We recently did a similar webinar on the Chicago spot market.

In the meantime, we thought we’d give you an overview of this critical Northeast supply point and a visual example of how OPIS’ spot fuel coverage fits into the picture.

Meet the New York Harbor Spot Fuel Market

The New York Harbor fuel markets are complex, with multiple trading origins and a vast system of pipeline and delivery points.

The region encompasses several “mini-markets,” if you will. OPIS assesses gasoline, diesel and jet fuel spot price points for all of them. The markets include:

- New York Harbor Barge

- New York Harbor Cargo

- Boston Cargo

- Buckeye Pipeline

- Laurel Pipeline

- Linden Junction

Overview of New York Harbor Supply Chain

The main supply point location is Linden, N.J. From there, pipeline and barges move products in and out of Linden Junction, to supply other regions.

Buckeye Pipeline supplies points in New Jersey, Pennsylvania and New York. Laurel Pipeline supplies points in Pennsylvania. The barge and cargo markets supply northern states including Connecticut and Massachusetts.

NYH News Alert!

A project has been in the works at Buckeye Partners LP to reverse the long-standing east-to-west flow on Laurel Pipeline. This has big ramifications for the New York Harbor region.

Buckeye is currently looking to secure approvals on the partial reversal on Laurel Pipeline, mainly between Altoona and Pittsburgh. The reversal would provide an outlet for growing production out of the Midwest, but Northeast refiners fear it could add more financial pressure on already struggling East Coast refining companies. As of now, East Coast supply can be shipped as far out as Pittsburgh.

Click here to stay on top of this and many more market-moving stories.

OPIS Full-Day Spot Coverage

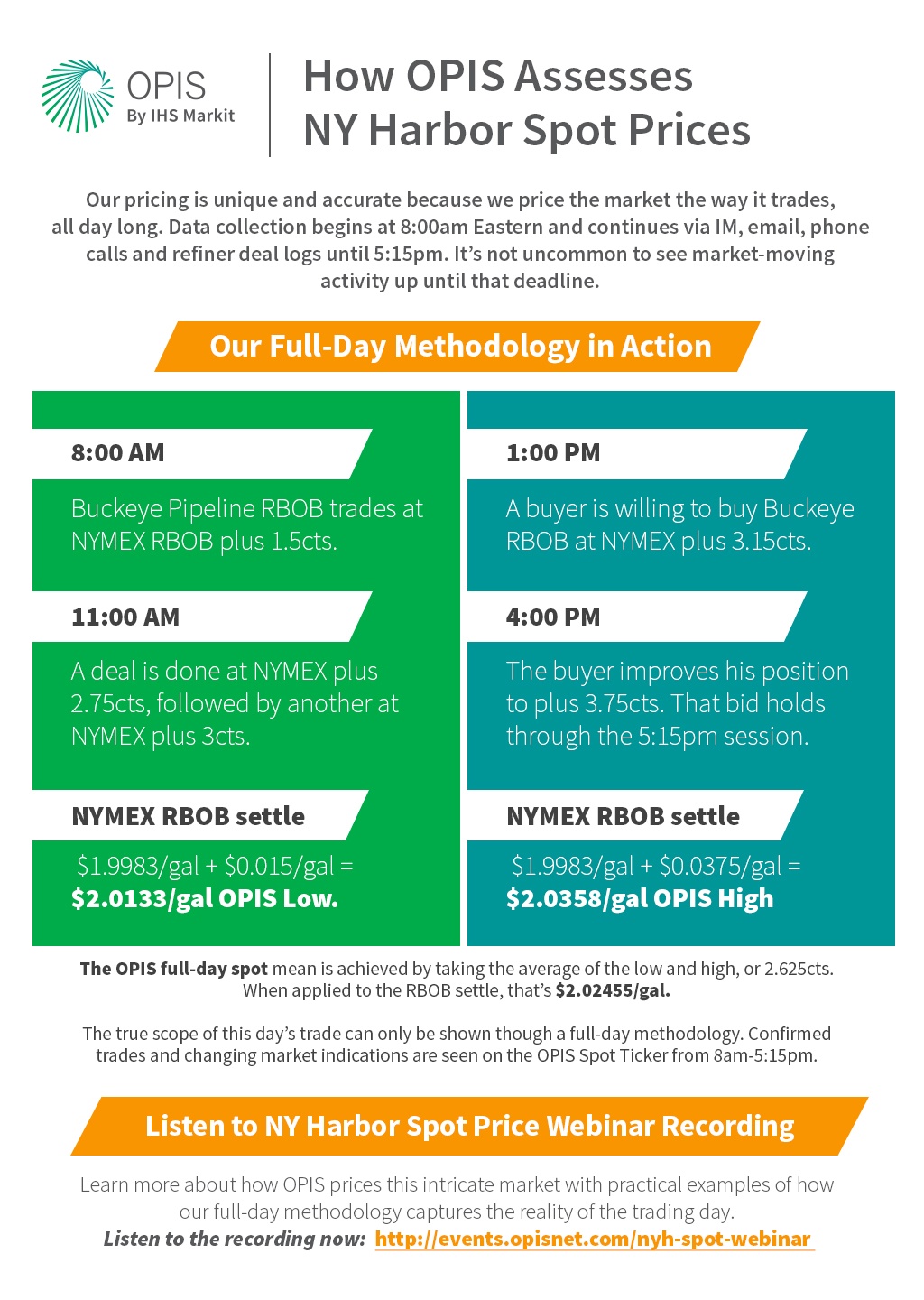

Our New York editors are at their desks saying good morning to sources and collecting data beginning at 8:00 a.m. Eastern Time. Their conversations continue throughout the day by instant messages, emails, phone calls and refiner deal logs up until 5:15 p.m. It’s not uncommon to see market-moving trade up until that deadline. At the end of the trading day, we then analyze the data we receive from industry participants.

It’s that approach to pricing that sets OPIS’ spot fuel pricing apart from our competitors in the NYH. We cover the market from 8:00 a.m. Eastern Standard Time until market closes at 5:15 p.m., reflective of the full trading day. And you can see every trade we confirm, as we confirm it, on the OPIS Spot Ticker. We also update price indications as bids and offers lead to increases or decreases in implied price values. That can help you predict what’s going to happen at the wholesale price level.

This info graphic below spells out a typical trading scenario our editors see when pricing fuel in the New York spot market.

Now that you have a general idea of how the New York Harbor spot market works and how OPIS covers fuel prices there, the next step is to listen to the recording of our free webinar. OPIS’ Carly John and Rachel Stroud-Goodrich explain how they cover this complex and influential market.