Mexico 101: Illegal Fuel Imports and Blends

Mexico in recent years has been battling illegal fuel imports and illicit blending of refined products, practices that pose a risk to consumers who purchase counterfeit fuel and undermine sales from legitimate suppliers.

The Mexican government has estimated that more than 180,000 b/d — or 15% of all fuel sold in the country in 2022 — was smuggled or stolen.

The Mexican government has estimated that more than 180,000 b/d — or 15% of all fuel sold in the country in 2022 — was smuggled or stolen.

Illicit suppliers undercut the market by avoiding taxes by mislabeling fuel imports as they enter Mexico from the U.S. or by creating dangerous blends with lower-cost components like methanol, naphtha, and base oils.

These illegal practices rose sharply as the Covid-19 pandemic began to ease and the Mexican government began taxing fuels at the full rate.

In April 2020, the untaxed landed price of U.S. gasoline on Mexico’s East Coast was 2.434 pesos/liter ($0.501/gal) but rose to more than 8.702 pesos/liter ($1.820/gal) after taxes were included.

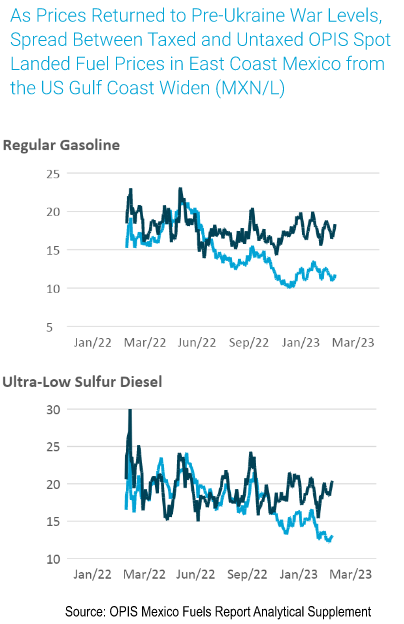

There is a correlation between taxation levels and the volume of fuel illegally sold in Mexico and OPIS has reported that the illegal fuel sales effectively stopped after Mexico began subsidizing retail fuel prices in the wake of Russia’s invasion of Ukraine in early 2022.

Subsidized spot gasoline in Mexico was priced at 0.753 pesos/liter ($0.156/gal) below the cost of fuel imported from the U.S. in June 2022.

OPIS has reported that illegal fuel volumes in the country began to rise after international fuel prices returned to pre-invasion levels and the government resumed taxing fuels.

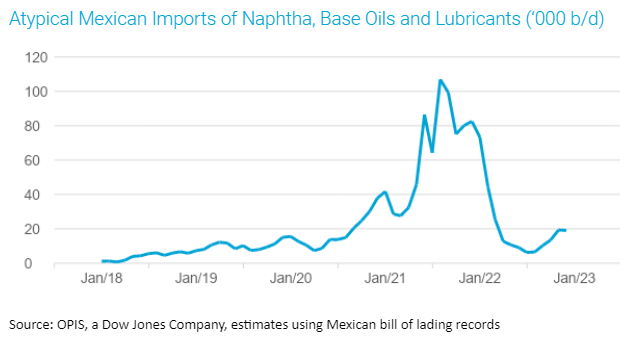

Atypical naphtha, lubricants, and base oil imports rose to an average of more than 19,000 b/d in November and December 2022 from a low of 6,300 b/d in June as Mexico implemented fuel subsidies.

OPIS calculated atypical imports of naphtha, lubricants, and base oils by reviewing the custom records of companies, which reported no operations in early 2018, but have since then accounted for unusually large imports into Mexico, including 41,750 b/d in January 2021.

OPIS only examined products in the customs family code for hydrocarbon products (HS 2710) and those numbers don’t include the unusual imports of ethanol, biofuels, and other products that also could be used to adulterate fuel imports.

OPIS first reported on the issue of illegal imports in February 2021 and Mexican President Andres Manuel Lopez Obrador later ordered the army to take control of customs points in the U.S.-Mexico border to better police imports.

OPIS first reported on the issue of illegal imports in February 2021 and Mexican President Andres Manuel Lopez Obrador later ordered the army to take control of customs points in the U.S.-Mexico border to better police imports.

As a result, atypical imports fell to 27,600 b/d in March 2021. But by August 2021, questionable import volumes increased to 106,900 b/d. In comparison, Mexico consumes 13,800 b/d of lubricants and base oils and Pemex’s naphtha imports in 2021 averaged 8,250 b/d.

Illicit Blends

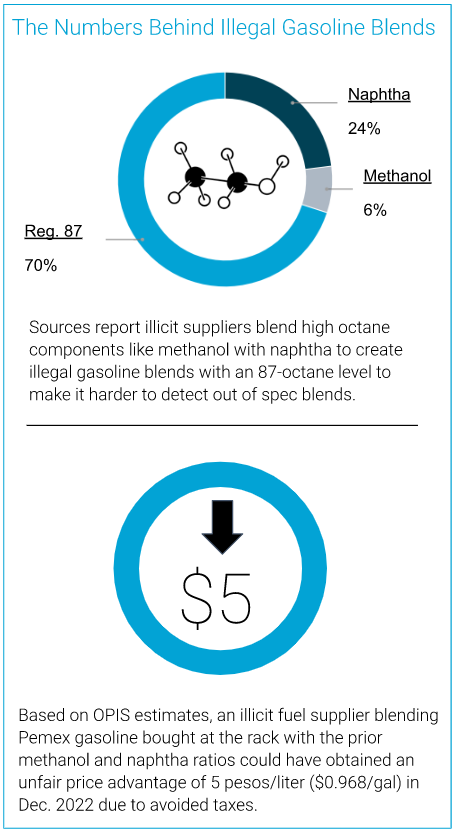

As the Mexican government subsidized fuel prices, illicit suppliers began blending more fuel with cheaper components to undercut legitimate suppliers on price, legal market players told OPIS.

The practice is becoming a larger problem as illicit suppliers have found ways to sell illegally adulterated gasoline with the required octane level, making it challenging for retailers to detect. OPIS has reported that laboratory tests have found gasoline blended with up to 30% naphtha and ethanol or methanol meets the required octane level.

The practice is becoming a larger problem as illicit suppliers have found ways to sell illegally adulterated gasoline with the required octane level, making it challenging for retailers to detect. OPIS has reported that laboratory tests have found gasoline blended with up to 30% naphtha and ethanol or methanol meets the required octane level.

The price of naphtha assessed by OPIS in the U.S. Gulf Coast last year averaged 9.822 pesos/liter ($1.9095/gal), compared with 14.651 pesos/liter ($3.066/gal) for premium and 13.056 pesos/liter for regular gasoline ($2.728/gal).

Combined methanol and ethyl alcohol imports in Mexico remain above pre-pandemic levels, reaching 10,700 b/d in December 2021, more than twice the volumes seen in 2019. After the start of the Russia-Ukraine war, these imports fell to 6,200 b/d in May 2022 and recovered to 8,500 b/d by the end of the year.

Counterfeit diesel is produced by blending the fuel with base oil or lubricants to lower its cost, sources have told OPIS.

Illegal fuel blending is a particular problem in the industrialized regions of the Bajio and Northern Mexico. Blending usually occurs when the fuel is transloaded at rail yards or at retail sites. Also, end-users who operate fueling sites for their operations and fleets frequently engage in these practices, market sources said.

According to Mexico City-based consulting firm Grupo Ciita there are between 13,000 and 15,000 self-fueling sites in Mexico, half of which may be illegal and lack fuel permits. Illegal blending is more likely to occur among transportation companies and small to mid-sized businesses, rather than larger companies, the sources said.

Mexican energy regulator CRE has said it plans to issue regulations to force self-consumption operations to prove the origin of their fuel and ensure that it is not from illicit suppliers.

Retailers who purchase fuel from smaller marketers are most likely to fall victim to adulterated products. But one fuel wholesaler told OPIS that some illegal importers have consolidated operations and secured access to infrastructure, such as transloading facilities at rail yards and storage and distribution tanks.

The Mexican Biofuels-Mobility Association (AMBM) has warned that vehicles can be damaged by the counterfeit fuel, which can affect an engine’s performance and efficiency depending on what has been added to the fuel. Illegal blends containing methanol can be particularly damaging because the product can produce formic acid. In a statement to OPIS, the association said it is difficult for drivers to identify when their vehicles have been damaged by adulterated gasoline.

Get a true buildup cost of cross-border shipments from the U.S. to Mexico with the brand new OPIS Mexico Fuels Report. It features a landed spot market index that assesses the price of Mexico-delivered gasoline, diesel fuel and jet fuel, based on the daily OPIS assessments for U.S. benchmark refined product spot markets. Try the Mexico Fuels Report free. It’s published daily and is available by email.