U.S. Ethylene Prices in Q1 2019: Less-Than-Happy New Year

As yet, the year 2019 has not provided much in the way of a Happy New Year for ethylene sellers. There are more than a few wildcards shaping the rest of the year.

Hello! I’m Kathy Hall, the executive editor of OPIS PetroChem Wire. I’ve been writing about U.S. petrochemical markets for more than 20 years and what a wild ride it has been so far! I’ll be giving quarterly market recaps for one of my favorite markets, ethylene, so watch this space for more ethylene price insights.

Please use the comments section to leave feedback and any suggestions you have for trends you’d like to see addressed in these pieces.

Want an updated version of this blog for Q2 2019? Click here.

Real quick, let’s recap: Ethylene is one of the most useful chemicals around. It is relied upon at manufacturing sites that produce thousands of other chemicals and products used in nearly every industry imaginable. (Think paints, coatings, labels, packaging, cleaners, fibers, alcohols, plastic goods.) Ethylene is created by a chemical process called steam cracking. Want more backstory on this essential chemical? Check out this blog for the basics.

OK, back to ethylene prices … Let’s begin with a stroll down memory lane, starting with the price of ethylene in Texas, a major production hub.

What Did 2018 Look Like for Texas Ethylene Prices?

In 2018, Texas ethylene’s highest price was 29 cents per pound (cpp), reached early in the year on Jan. 18. Its low was found just four months later, at 12 cpp on May 10.

Spot ethylene prices clawed their way back to 15.5 cpp by early June, but the gains were short-lived and prices slipped back to 12.25 cpp by the end of that month.

Not down for the count, prices got up to 15.5 cpp by mid-July, but eased to 14 cpp by August.

From there, it was a slow and steady march upward to 23 cpp in mid-September. The fourth quarter was a rangebound time, with spot prices bobbing and weaving in the 19-20 cpp range, ultimately ending the year at 19.375 cpp.

Let’s put this into context: These may seem like small numbers (we’re not even reaching 30 cents). But when you attach the mammoth volumes associated with a typical ethylene deal, 30 cents quickly becomes a million dollars or more. A typical spot ethylene transaction is between 3 million and 5 million pounds, with some deals seen for as much as 10 million pounds.

Buying 5 million pounds of Texas ethylene at 13 cpp in May and selling it at 23 cpp in September would have netted you a profit of 10 cents. On 5 million pounds, that’s $500,000. The average price — using all 250 daily closing prices in 2018 for Texas ethylene — was 18.25 cpp. So, ending the year at 19.5 cpp beat the annual average.

For a seller, that should be great!

But, hold up! Let’s pull the lens back before we get into 2019. Looking at the past five years, Texas ethylene prices averaged 39 cpp — and prices were 58.5 cpp at the start of 2014. (Cue the sad trombone for that 19.375 cpp, right?)

Now let’s look at some related fundamentals — natural gas and ethane pricing. Here’s how they stack up:

| TX ETHYLENE | ETHANE | NAT GAS |

18-Jan-18 | $0.29000 | $0.27875 | $3.189 |

10-May-18 | $0.12125 | $0.25750 | $2.814 |

28-Sep-18 | $0.20000 | $0.58500 | $3.008 |

31-Dec-18 | $0.19375 | $0.29250 | $2.940 |

On a percentage basis, it looks like this:

| Ethylene % of Ethane | Ethane % of Nat Gas |

18-Jan-18 | 309% | 133% |

10-May-18 | 140% | 139% |

28-Sep-18 | 102% | 296% |

31-Dec-18 | 197% | 151% |

Well, look at that — ethylene at 12 cpp (in May) was more profitable than ethylene at 20 cpp (in September). Finishing the year just shy of 20 cpp, ethylene was in a fairly healthy position at nearly 200% of its main feedstock, ethane. BTW, if you need a little more context on the relationship between ethylene and ethane, this blog’s for you.

A Spotlight on Louisiana Ethylene

Before we leave 2018 behind, let’s not forget Louisiana, which produces roughly 23% of U.S. ethylene (Texas is 74% and the Midwest is 3%).

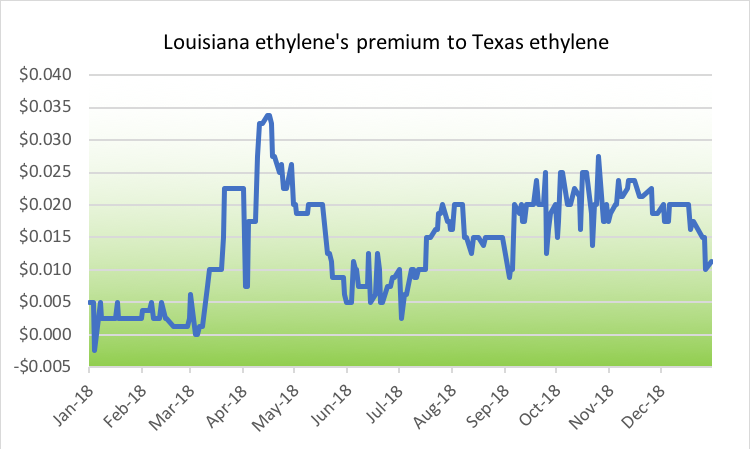

Louisiana ethylene has historically held a premium to Texas ethylene. This (in my opinion) is largely because there are fewer plants than in Texas and consumption in Louisiana requires a certain amount of ethylene from Texas to be shipped over — and that ain’t free.

The typical premium is 2-3 cpp. The record was nearly 20 cpp back in 2014, about a year after the then-Williams ethylene plant shut following an explosion and other outages in Louisiana created a screaming short market.

In 2018, Louisiana ethylene held an average premium of 1.43 cpp to Texas ethylene. Louisiana was below Texas pricing exactly once during 2018 — on Jan. 5, when it was 0.25 cpp below Texas. Its largest premium to Texas was in April, when Bayou State ethylene was nearly 3.5 cpp above that in the Lone Star State. That spread has turned rather interesting in recent weeks, but more on that in a bit …

Let’s Ring in 2019 for Ethylene Prices!

January’s major fundamental for many producers and consumers is that the inventory calendar starts anew. Those anxious to end the year with low inventories are unafraid to rebuild in January, now that year-end ad valorem taxes are paid (ad valorem is Latin for “according to the value”).

Inventory building creates a demand bubble and prices typically rise.

But, not this January. Texas ethylene began the year trading at 18.25 cpp and prices eased to 17.75 cpp in the first week of the month before rebounding somewhat to 19.25 cpp mid-month.

Trading in such a tight range inspires what I call “micro-testing.” Seeking a market ceiling or floor is a constant pattern of behavior in any market. What ethylene showed us in January is that markets found their floor at 17.75 cpp and their ceiling at 19.25 cpp, a mere 1.5 cpp distance. Most days, prices moved in very small increments and “corrections” (when a market is demonstrated to have been oversold or overbought) were minuscule as well, with the largest swing at 4% on the day and most days’ volatility being 1-2%. For those who bank on volatility, January was a tough market.

Ending the month at 17.25 cpp, Texas ethylene prices fell nearly every day in February as of this mid-month writing. Operating rates are high; ethane is around 30 cents per gallon.

Meanwhile, a new wrinkle on the customer side has presented itself: railcar jams throughout the Gulf Coast.

High levels of rail inventory in the Midwest, Canada, the Northeast and in Houston prompted terminal operators and railroads to place restrictions on inbound traffic during January. Polyethylene producers, in particular, were pressing their customers more urgently for the return of empty railcars.

While January is historically a slow month for exports from the United States to Asia, due to the Lunar New Year holidays in early February, U.S. plastics exporters reported various logistical bottlenecks this year, including a lack of empty containers in New Orleans and tight vessel space out of Houston, that were delaying the movement of packaged inventory from warehouses.

So, while the ethylene producers are pumping out millions of pounds every day, many of their buyers are shrugging. No one is asking for more. The nation is not necessarily swimming in ethylene nor choking on polyethylene, but supply is certainly surpassing demand as of mid-February.

And so, spot ethylene prices in Texas have fallen to 15.25 cpp at this writing (Feb. 19), their low for the year.

Meanwhile, a curious thing has happened in Louisiana — ethylene actually began trading at a discount to Texas. While we noted one instance of this in 2018, this started happening on Feb. 1 and has persisted.

Is Texas ethylene strong, or is Louisiana ethylene weak? Considering that Texas ethylene is at its year-to-date low, I’m going with the theory that Louisiana ethylene is particularly weak. All ethylene plants in Louisiana are operating at or close to 100%, and the market awaits the startup of four brand new plants sometime this year:

- Indorama’s plant at Lake Charles that was expected to start up in late 2018 is understood to be in the startup process during the second half of February.

- The joint-venture Lotte Chem and Westlake plant at Lake Charles is expected to start up by the end of 1H 2019, according to company estimates.

- The Shintech Plaquemine plant’s mid-2018 startup was delayed following various issues with a contractor (Chicago Bridge & Iron) and has no official startup target date. Unofficial expectations have the unit starting up by the end of June.

- Sasol’s plant at Lake Charles that was expected to start up in late 2018 is understood to now be targeting August.

The timing of these startups and, more importantly, their associated downstream units, is crucial to how the rest of the year will go. If the ethylene plants and their downstream consuming plants start up together, everything goes according to plan and market disruption would be minimal. They make the ethylene, they eat the ethylene right there at home.

If the downstream units start up before the ethylene units that feed them, there could be a sustained rush on ordering in spot market ethylene. Conversely, if the ethylene plants start up without a hitch and the downstream units experience sustained problems, the market could be flooded with unconsumed pounds — if the units don’t throttle back rates.

So, 2019 has not turned out to be such a Happy New Year for ethylene sellers so far, and the rest of the year seems to be colored with unknowns. The downside for buyers in this market is that even though low prices expand their margins, they also weigh heavily on their own products, casting a bearish pall all the way down the supply chain.

We are past the time of year when Texas and Louisiana are generally susceptible to bitter cold snaps and freezes that can take down more plants than a mild hurricane, so if ethylene plant operating rates drop, it will be because operators have decreased operating rates. We haven’t seen that yet, but we’ll check back and let you know the situation in our mid-2Q market update.

OPIS PetroChem Wire Daily provides prices that reflect how the ethylene markets really trades. Learn more about this report and try it free.