Why and How Are Companies Pursuing 24/7 Carbon-Free Energy?

Google, in 2017, realized that although it had met its corporate goal of matching 100% of the electricity it used that year with renewable power, it still fell short of net zero Scope 2 emissions. In answer, and at a significant expense, the company pledged to match 100% of the electricity it consumed with renewable power not on an annual basis, but on an hourly one.

Since, a number of businesses, including Iron Mountain and Microsoft, have also laid plans to procure 24/7 carbon-free energy (CFE).

“These strategies help us imagine a world where we track all generation,” said Neil Fisher, a partner at energy consulting firm Northbridge Group. “It’s done on a time-specific, location-specific basis. And it allows us to evaluate and reduce carbon emissions on a more granular scale. That’s what we’re all striving for here.”

This is the first installment of two covering why companies have decided to implement 24/7 CFE and how the trend could impact the global market for renewable energy credits (RECs). A REC is a market instrument that represents the environmental attributes of one megawatt hour of electricity generated by a renewable source. View part two.

RECs and Other Renewable Procurement Strategies in Play

To understand 24/7 CFE, it’s first important to explore the ways in which companies reduce their emissions and the effects those methods have on electric grids.

When a company sets out to reduce its emissions, it often has to account for the carbon dioxide released into the atmosphere from generating the electricity it consumes. That source, along with emissions relating to purchased heat, steam and cooling, represent Scope 2 emissions. To reduce Scope 2 emissions, companies typically will buy renewable power.

In most cases, companies claim renewable power usage but aren’t physically running on carbon-free sources like solar or wind. Instead, they purchase and retire RECs to claim their environmental attributes.

RECs were originally created in the 1980s to help facilitate state climate laws known as renewable portfolio standards (RPS). These regulations, which are still around today, originally incentivized renewable deployment and increased energy grid resilience.

The Greenhouse Gas Protocol, and How Companies Voluntarily Decarbonize

Beginning in the late ‘90s and early 2000s, companies also started buying RECs to fulfill voluntary emissions reduction pledges. Both utilities in states with an RPS and companies fulfilling decarbonization pledges buy and retire RECs to claim their environmental attributes. This voluntary practice by companies is, in most instances, guided by a document called the Greenhouse Gas Protocol.

First published in 1999 by the World Resources Institute (WRI) and the World Business Council for Sustainable Development, the Protocol has served as a primary resource for most industry groups focused on voluntary corporate decarbonization, such as the Science-Based Targets initiative (SBTi) and RE100. (The subsequently released Corporate Accounting and Reporting Standard provides further clarification for companies.)

The Protocol allows businesses to account for Scope 2 emissions in two different ways: the location-based method and the market-based method.

The location-based method allows businesses to calculate their emissions by determining the average emissions associated with a given amount of electricity production and consumption in the regions where they operate. Under the location-based method, businesses must directly reduce emissions in some way, like investing in weatherization or energy efficiency, or simply lowering overall electricity consumption. The market-based method allows businesses to measure emissions based on the contracts they sign with utilities, power generators and other market participants. In addition to the steps allowed by the location-based method, the market-based method also allows businesses to reduce emissions by opting in to green power programs, signing green tariffs or purchasing RECs (like utilities do to satisfy state mandates).

Enter 24/7 CFE

Through the 2010s, companies that followed the Greenhouse Gas Protocol began to achieve net zero Scope 2 emissions on paper. But shortly thereafter, many began to understand that their energy use still resulted in significant Scope 2 carbon emissions.

How is it that a company can match 100 percent of its energy use with renewable power but still cause carbon emissions? The answer lies in the realities of renewable sources and the grids on which they operate.

Many renewable sources only introduce power to the grid at certain times. Solar farms only generate when the sun is shining. Wind turbines only turn when the wind is blowing. Even grids that enjoy a large renewable capacity still need to resort to carbon-emitting generation when renewable sources are not available.

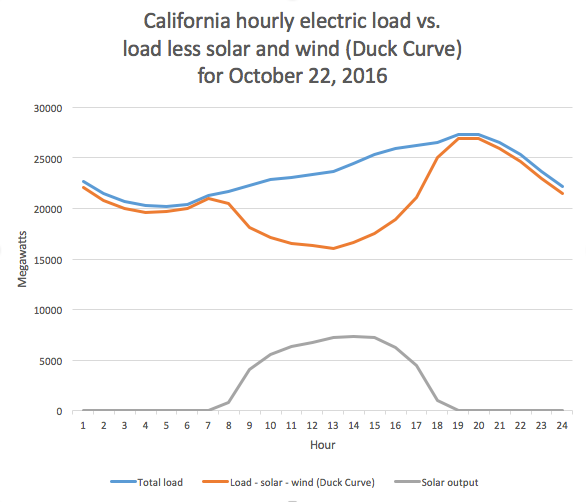

And while wind and cloud patterns can be difficult to predict, human power consumption is fairly routine. On a graph, it resembles the side profile of a duck, and energy experts often refer to it as a “duck curve.”

There is a rise in consumption in the morning when the world wakes up (the duck’s tail), consumption drops through the morning and into the afternoon (the duck’s back), and then it rises rapidly and peaks in the evening (the duck’s head), before dropping down to a low trough and starting again the next day.

There is a rise in consumption in the morning when the world wakes up (the duck’s tail), consumption drops through the morning and into the afternoon (the duck’s back), and then it rises rapidly and peaks in the evening (the duck’s head), before dropping down to a low trough and starting again the next day.

Renewable generation, however, does not follow the same duck curve. Solar generation peaks at noon, right when demand dips in the middle of the day. Wind patterns might match peak load on some days, but be nonexistent on others. In most regions, even those with significant wind and solar resources, a carbon-emitting firm generation source—or one that can dispatch electricity at any hour of the day—is required to meet peak load demand.

If a company operates during peak load periods or when renewable power is unavailable, but only buys RECs generated during daylight hours, their REC purchases do not counterweigh their Scope 2 emissions on a 1:1 basis.

After Google achieved net zero Scope 2 emissions, it realized that, on a more granular basis, its renewable energy purchases matched, or offset, the energy used by its data centers in a range of 96% to just 3% of the time, with an average match of 61%. The remainder was often supplied by carbon-emitting sources.

RECs had proven they could send a market signal to spur the early development of renewable power. Then, as businesses began to achieve 100% net zero on an annual-matching basis, many members of the renewable energy sector began to consider how a similar signal could be sent to encourage deep grid decarbonization.

The answer they devised—and that Google and energy partner AES adopted—was 24/7 CFE.

In its most basic sense, 24/7 CFE switches the accounting mechanism of renewable energy procurement from annual to hourly matching—or at least more granular timescales. It might also involve a location-matching component.

By matching every hour of energy usage with renewable power, a business can actually achieve net zero Scope 2 emissions.

“I think there’s two different motivations here,” said Fisher. “You know, there’s one motivation driving the renewable energy certificate (REC) market, which is to deploy as much solar and wind as we can. The other is getting to net zero emissions in the electric sector. They’re not necessarily in conflict with one another, but there is very much a different timeframe and strategy associated with them.”

WRI, meanwhile, announced in March that it had initiated a review of the Greenhouse Gas Protocol, including the Corporate Accounting and Reporting Standard. As a first phase, researchers from Concordia University in Montreal were tasked with studying current voluntary practices. (Much of this work has already been published, such as “Renewable energy certificates allow companies to overstate their emissions reductions,” by Bjorn et al in Nature on June 9.) That phase has been followed by a global survey of stakeholder consultants.

Putting the Puzzle Together

Google, in 2020, pledged to achieve 100% 24/7 CFE by 2030. A year later, it announced it had struck a deal with energy provider AES—involving existing contracts and future developments—to supply its data center in Arlington, Virginia with renewable energy 90% of the time.

Following this news, the global renewable energy community set about trying to scale this strategy and make 24/7 CFE more widely available and accessible. The first hurdle to clear in this effort was creating the ability to transition RECs from annual or monthly origination to hourly.

The non-profit EnergyTag had already launched in November 2020 to do just that. Founded by Toby Ferenczi, the organization began authoring a standard by which REC verifiers could assign the certificates a location and time of origination. It published its Granular Certificate Scheme Standard in March of this year.

Google and AES announced their strategy on May 4, 2021. The Midwest Renewable Energy Tracking System (M-RETS), which develops a REC tracking and management platform, built hourly tracking capabilities and conducted the first hourly REC transaction for Google in early 2021.

Support for 24/7 CFE grew through that year.

In July, Microsoft announced it would achieve “100/100/0” (100% renewable energy 100% of the time with zero associated emissions) by 2030. On September 21, Google, AES, Sustainable Energy for All, UN Energy and a cohort of the renewable energy sector announced the 24/7 Carbon-Free Energy Compact, a group committed to the practice. Then in December, President Joe Biden signed an executive order directing the federal government to achieve 24/7 CFE by 2030 as well.

24/7 Alternatives

Other organizations, furthermore, have pursued strategies targeting time- and location-specific renewable energy in ways that aren’t strictly 24/7 CFE. Meta (formerly Facebook), for example, requires its renewable procurements all derive from the same grids in which its data centers operate. Boston University, in 2018, signed a virtual power purchase agreement (VPPA)—a long-term contract for the purchase of RECs deriving from a specific renewable development—with a wind farm in South Dakota because that development would have a higher impact than one located in Massachusetts, which already has comparatively higher renewable generation capacity.

By this stage, the basic framework for a 24/7 CFE marketplace was missing just one piece. Most utilities and regional transmission organizations (RTOs) were used to tracking RECs by the month, if not longer periods of time. They lacked the tools to manage their energy portfolios on a more granular basis.

Toby Ferenczi transitioned out of his role at EnergyTag and founded Granular Energy along with Bruno Menu and Samuel Cheptou to develop such a product.

“This is what we think is going to be needed to take 24/7 CFE out of the realm of a couple of very large corporates like Google and Microsoft,” Ferenczi said. “They are really important and doing great work by being the early adopters. But they also have resources that the vast majority of companies do not.”

Microsoft and Constellation followed a few months later. In March, the two companies announced they were working together to develop a 24/7 CFE accounting software product. Microsoft would be the first user and adopt the tool to pursue its own decarbonization plans.

Working Towards 24/7 CFE

A company could theoretically achieve 24/7 CFE today. A business could build a utility grade geothermal generator, subscribe to hydropower, or source power from a wind farm located in a region where the wind almost never stops blowing (such places exist). But in the words of Clean Energy Brokerage VP Ryan Cook, “the cost will be quite significant.”

Google, Microsoft, Stone Mountain and every business pursuing this goal are doing just that: they have begun their 24/7 CFE journey and won’t expect to reach that goal for years.

In many instances, businesses chasing 24/7 CFE will first look to solar and wind to power as much of the day as possible. In the past few years, battery storage has also become a meaningful addition to this system. Utility grade batteries today can store power and discharge it for roughly four to six hours, depending on the system.

That means that, when excess solar production occurs during the day, batteries can come online in the evening, just as another peak of the duck curve is climbing.

But as Bruce Phillips, partner at Northbridge Group highlights, this is just the tip of the iceberg.

“It’s not just a daytime-nighttime problem,” Phillips said. “The biggest problem is a seasonal one.”

As mentioned above, duck curves look different depending on season and region. Most of the US receives over 14 hours of daylight at the summer solstice and under 10 hours during the winter solstice. Heating and cooling needs vary widely, and peak load times shift accordingly. As such, widespread 24/7 CFE cannot be achieved with the current state of wind, solar and battery storage technology.

On the other hand, no one believes this is going to happen overnight. And more organizations have started to understand the merits of a 24/7 CFE procurement strategy. M-RETS has already developed the capability of conducting granular REC transactions. The New England Power Pool (NEPOOL), the RTO serving the region, is considering following suit.

“It won’t be for every generator in the region,” said Paul Belval, counsel to NEPOOL. “It will be for those that want to opt in.”

PJM, the RTO serving a swath of Mid-Atlantic and Midwest states, is also considering accommodating hourly RECs. ERCOT declined to comment on the matter.

Incremental Progress Toward an Ambitious Goal

Utilities, meanwhile, are moving ahead. Duke Energy, in October, proposed a “100% renewable” service program to the South Carolina Public Utilities Commission. The company plans to file a similar proposal in North Carolina.

The program would allow certain customers to assume part of the cost of installing combined solar and battery storage systems to “virtually time-align with the participating customer’s load,” said Leland Snook, managing director of rate design and regulated solutions at Duke.

“Some customers are starting to want this,” Snook said. “It’s not the majority yet. These are customers that are leading the way. 24/7 will be facilitated by new technologies. Batteries are first in the queue for that, but they will only get you so far. This is going to be an evolving, cutting-edge strategy.”

Easily keep up with the complex and evolving biofuels market. Try OPIS Ethanol & Biodiesel Information Service free for 3 weeks. You’ll get real-time news alerts and a daily market overview that includes pricing assessments, plus a weekly newsletter and rack pricing report in PDF format. Delivery is via email.