OPIS Chicago Location-Specific Spot Pricing Options: More Ways to Improve Your Bottom Line

In 2020, OPIS launched Chicago location-specific refined spot pricing assessments for Buckeye Complex, Wolverine Pipeline and West Shore/Badger Pipeline, providing greater insight into the spot pricing dynamics of the greater-Chicago region.

Understanding how these location-specific spot markets are priced may help you make better pricing decisions and ultimately help your bottom line.

The launch of Chicago location-specific assessments was based on changes to the Chicago spot market supply landscape. The 2016 decision to permanently close West Shore Pipeline in Wisconsin, from Milwaukee to Green Bay, and the 2017 decision not to replace the only fuel pipeline to Green Bay has altered West Shore/Badger Pipeline market. Additionally, the 2017 expansion of Wolverine Pipeline, enabling delivery of refined products to the Chicago area, has increased accessibility of the pipeline.

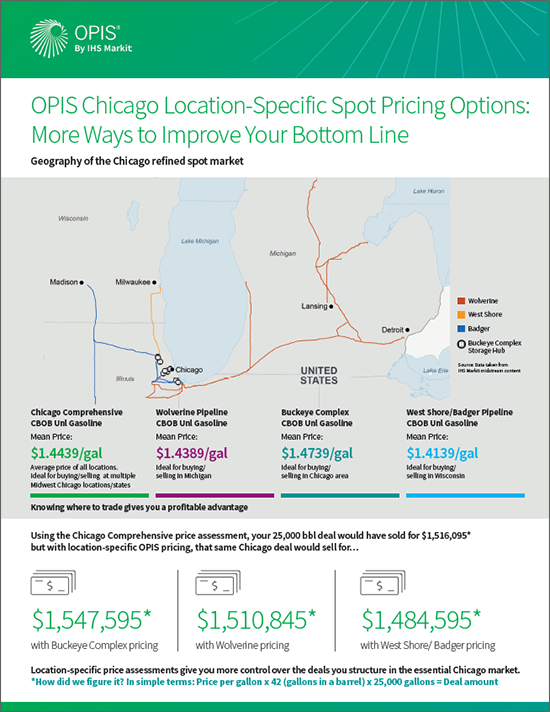

Each location-specific market serves a different geographic area. Buckeye Complex serves as the center of the Chicago region, housing a capacity of more than 7 million bbl of refined products and supplying the immediate region. The complex also offers connections to pipelines throughout the Upper Midwest – from Wisconsin to Ohio. Wolverine Pipeline, located to the east of the Buckeye Complex, runs east, serving markets from Indiana to Michigan. West Shore/Badger Pipeline, west of the Buckeye Complex, serves markets from Indiana into Illinois and Wisconsin.

OPIS launching spot pricing assessments for Buckeye Complex, Wolverine Pipeline and West Shore/Badger Pipeline provides additional pricing insight and transparency, particularly for customers who look more closely at one of those specific regions. Often there can be significant price differences between each location. With a wide geographic spread into a multistate region in the Upper Midwest, those pipelines and the storage complex can be subject to different pricing dynamics and see sizable pricing discrepancies.

OPIS launching spot pricing assessments for Buckeye Complex, Wolverine Pipeline and West Shore/Badger Pipeline provides additional pricing insight and transparency, particularly for customers who look more closely at one of those specific regions. Often there can be significant price differences between each location. With a wide geographic spread into a multistate region in the Upper Midwest, those pipelines and the storage complex can be subject to different pricing dynamics and see sizable pricing discrepancies.

Meanwhile, OPIS continues to provide Chicago Comprehensive spot assessments — which include all confirmed transactions in Buckeye Complex, Wolverine Pipeline and West Shore/Badger Pipeline — if those better represent your operations. For example, if you buy/sell refined products throughout multiple Chicago-area states, it may better fit your pricing needs to use the comprehensive spot assessment. But, if you buy/sell only in Michigan, it may better serve your bottom line to use a Wolverine Pipeline spot assessment.

There are several factors that influence price discrepancies between the major Chicago markets.

- West Shore/Badger Pipeline has fewer options for deliveries, and destinations along that pipeline system tend to be more remote.

- For Wolverine Pipeline, it has some similar characteristics as the West Shore/Badger system, but barrels can also be shipped to/from Buckeye Complex, which provides more optionality, especially when barrels in Buckeye Complex are pricing at a premium to those on Wolverine Pipeline.

- Buckeye Complex, a storage facility, has the most flexibility of all regions, and has access to Buckeye Pipeline. However, barrels in Buckeye Complex tend to be at a premium to the other location-specific markets because of its ability to store barrels.

OPIS tracks each of the locations the same way the market trades: from 9 a.m. to 5:15 p.m. ET., capturing the entire day’s activities. Bids set the market floor, offers set the market ceiling and trades are the market. The trade information that fuels our assessments comes from the more than 150 confirmed and vetted Midwest sources, with data verification conducted transparently by mass communicating information across the ICE Chat messaging system and live updates on the OPIS Spot Ticker.

Submit the form below to download the full-size infographic.