Asia Remains Key to U.S. Polyethylene Industry’s Export Strategy

US polyethylene producers have a domestic demand problem, with year-to-date sales to North American customers off nearly 9%, according to April industry data compiled by the American Chemistry Council (ACC). Post-pandemic destocking and soft consumer demand have put a major dent in the order books of plastic processors.

The cure? More exports!

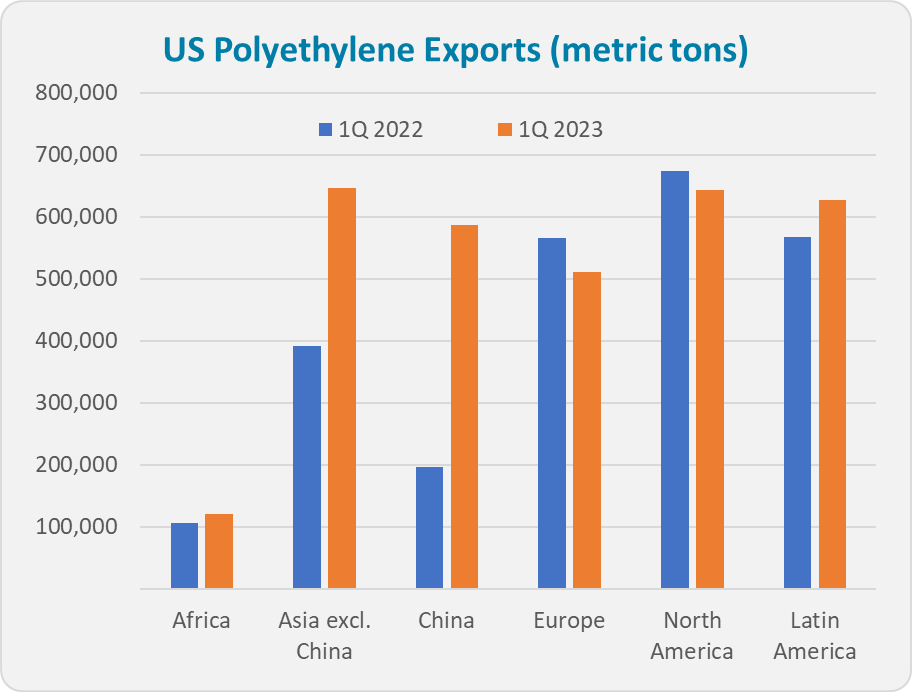

US PE export shipments over the first three months of 2023 were up 30% versus the prior year, at 3,196,437 million metric tons (mt), or 7.05 billion pounds if you are so inclined, according to the US Commerce Department.

That total figure is made up of the five major categories of PE in the trade data structure: Linear low density polyethylene (LLDPE), low density polyethylene (LDPE), medium density polyethylene (MDPE), high density polyethylene (HDPE), and ethylene-alpha-olefin copolymers.

Drill down into the data, and another striking feature emerges. First quarter export volume to Asia is up 110% year-on-year, far outpacing the growth in shipments to Europe and South America (+11%), Africa (+14%) and Mexico/Canada (+5%). Further narrowing the focus to China, export volume is up 200%, triple the amount seen in early 2022.

Drill down into the data, and another striking feature emerges. First quarter export volume to Asia is up 110% year-on-year, far outpacing the growth in shipments to Europe and South America (+11%), Africa (+14%) and Mexico/Canada (+5%). Further narrowing the focus to China, export volume is up 200%, triple the amount seen in early 2022.

In absolute terms, first quarter PE shipments to Asia increased by 645,241 mt to 1,233,005 mt, more than offsetting the 322,000 mt decline in domestic demand reported by ACC.

Ethylene-alpha olefin copolymer exports to Asia increased by more than 285,000 mt. That category, which includes conventional and metallocene-based hexene and octene LLDPE grades, also happens to be the type of capacity that has grown the most in recent years in the US.

LLDPE butene and HDPE first quarter exports to Asia were up 116,772 mt and 199,086 mt, respectively, from a year earlier.

On the other hand, LDPE exports to Asia increased by a modest 36,214 mt in the first quarter versus the prior year, reflecting the relatively weaker global market picture for LDPE. US LDPE exports globally were up only 3% in the first quarter, well below the aggregate increase of 30%.

What’s Behind the Increase in Exports?

If you listened to any manufacturer’s earnings call for 4Q 2022, you were sure to hear the word “destocking,” which is another word for retailers slowing or halting finished goods orders because they realize that they have too many goods in the warehouses and on store shelves. The buildup of that inventory was quite visible in all those inbound container ships jamming U.S. ports in early 2022.

With retailers pulling back on orders, and consumers experiencing sticker shock from high inflation, there was much less domestic demand for PE, and North American PE sales hit a seven-year low in December 2022, according to the ACC data.

Rather than finish 2022 with a massive overhang of PE inventory, U.S. producers slashed export prices into the low 30s cts/lb railcar FOB Houston in November and December, according to data from PetroChem Wire by OPIS. Opportunistic buyers in China and elsewhere sprang into action. The resulting surge of export volume played out over the next couple of months as cargos were packaged and shipped.

The shortage of shipping containers and trucking that plagued the Gulf Coast PE industry in early 2022 also eased because there were fewer inbound containers clogging up the ports. This facilitated the higher level of export shipments in early 2023. US PE producers are projecting smooth sailing for export logistics in the foreseeable future.

U.S. PE producers saw domestic demand pick up in 1Q 2023, albeit from a very weak 4Q. However, there are signs that the 2Q rebound in demand has been weaker than expected. Some domestic processors expect even weaker conditions in 3Q.

With that scenario in mind, international PE traders are taking a very cautious approach, minimizing their inventories and bracing for further price decreases. The benchmark HDPE blow molding grade has fallen from 44 cts/lb railcar FOB Houston in early March to 35 cts/lb at the end of May.

In Asia, the bellwether China market is growing slower than in pre-pandemic years, although US petrochemical majors seem hopeful that the Chinese government will step in with new stimulus programs in the second half of 2023. China is also adding capacity to increase its self-sufficiency in PE, and local Chinese producers are said to be running at full rates even as regional naphtha-based production economics appear less than healthy.

U.S. spot export prices are likely to push lower in June 2023, traders say, matching the levels seen during the December 2022 export push. Whether that will be enough to inspire a fresh surge of export business with the key Asian markets remains to be seen.