Analysis: Latest Rise to $90/bbl Crude Underscores Dramatic Downstream Changes

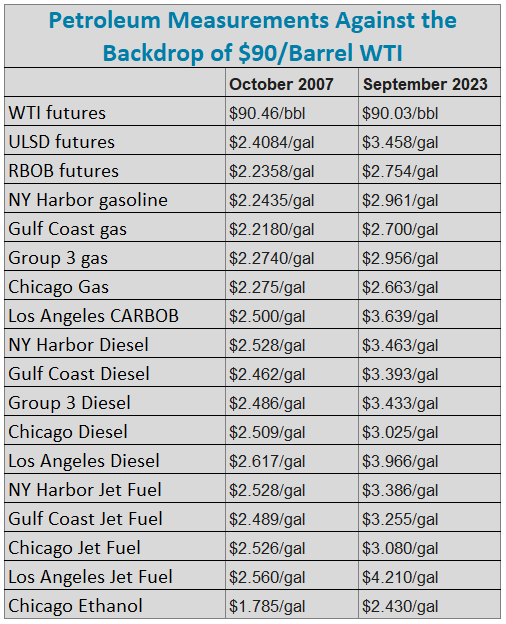

On September 14, 2023, front month WTI futures surpassed $90/bbl for the first time since November 2022.

Oil first broached $90/bbl way back on October 25, 2007, on its way to an eventual rendezvous with $145/bbl in 2008.

The move above $90/bbl was a big deal back in 2007 and it is a similarly big deal in the present time. But an analysis of the numbers then and now speaks to the dramatic changes that have occurred in the last 191 months in the downstream fuels’ arena.

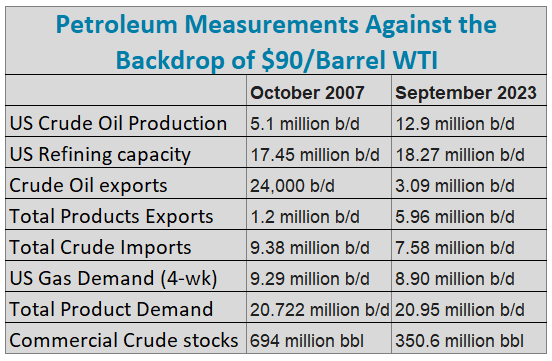

The US population back in autumn 2007 was approximately 303 million, compared with just over 340 million people today. Gasoline demand numbers, however, were similar. A four-week EIA average of implied demand then was 9.295 million b/d, compared to about 8.9 million b/d currently. Yet, retail gasoline on October 25, 2007, was a relatively pedestrian $2.819/gal, compared to the present day average of $3.581/gal. Diesel shows a similarly large difference with a 2007 level of $3.16/gal compared with a present quote of $4.53/gal.

Put simply, US pump prices for transportation fuels are now more than $1/gal higher than they were when the domestic crude oil benchmark first surpassed $90/bbl. Those gains are largely due to dramatically higher refinery margins as well as more profit for gasoline distributors and retailers.

There is also the issue of compliance with the Renewable Volume Obligation, which refiners didn’t have to contend with in the “RIN-less” markets earlier this century. Merchant refiners currently face RVO charges that can sap about $7/bbl of gasoline and distillate cracks.

Still, price points one sees in the final days of summer 2023 speak to the drastic improvement in profit margins for refiners in every region of the country. The most staggering increases show up in the middle of the barrel with incredibly lucrative profits on jet fuel and diesel.

Southern California is the poster child of sorts for those improved profit margins. The region tends to use heavy California crude that sells at a discount to CME WTI, but spot jet fuel in Los Angeles fetches a value of $4.21/gal or approximately $177/bbl. It is quite possible that some of the most efficient operators are selling jet fuel for twice the cost of crude. Returns on diesel aren’t exactly chopped liver, with CARB diesel pegged on the morning of Sept. 14, 2023, at $3.966/gal or approximately $166.60/bbl. That compares with a much more moderate CARB diesel price of $2.617/gal back in October 2007.

Southern California is the poster child of sorts for those improved profit margins. The region tends to use heavy California crude that sells at a discount to CME WTI, but spot jet fuel in Los Angeles fetches a value of $4.21/gal or approximately $177/bbl. It is quite possible that some of the most efficient operators are selling jet fuel for twice the cost of crude. Returns on diesel aren’t exactly chopped liver, with CARB diesel pegged on the morning of Sept. 14, 2023, at $3.966/gal or approximately $166.60/bbl. That compares with a much more moderate CARB diesel price of $2.617/gal back in October 2007.

Surprisingly, total products demand is very close to what it was back in 2007, but refined products’ prices are higher thanks mostly to the exponential rise in exports. The only crude oil exports that were possible back in 2007 had to do with Alaskan oil swaps with Asia. In the first week of September 2023, the reading of 3.09 million b/d of crude leaving for foreign destinations was well shy of some previous weeks, but represented a 128-fold increase from the autumn 2007 level.

The other dramatic difference can be viewed in controversial inventory held by the Strategic Petroleum Reserve. Stocks stood at nearly 694 million barrels back in 2007, and indeed the administration of George W. Bush kept adding to stockpiles despite high costs, with over 701 million barrels accrued by the time the president left office.

Fans of emergency SPR sales would stress that the US was much more dependent on crude oil from locations outside of North America sixteen years ago.

Refinery consultants also point out that Latin America in 2023 is much more dependent on gasoline and diesel produced in the US, mostly at refineries in Texas and Louisiana. Sixteen years ago, Latin American refining capacity was significantly higher than it is today. The failure of PDVSA operations across a number of countries accounts for substantial refining losses in the hemisphere.

The numbers speak to the difficulty that energy equity analysts now have in predicting future refinery performances. Until recent years, a $20/bbl return might represent a superlative margin for gasoline or distillate. More recently, processors are enjoying margins that are several times more lucrative than what is regarded as “midcycle.” Jet fuel and distillate in Southern California today command anywhere from $76-$87/bbl above the price of WTI.

There is one other issue worth mentioning as WTI trades around the $90/bbl mark. The comparison to October 2007 gasoline numbers needs to be viewed in the context of autumn specifications that often cheapen the production of gasoline.

Starting on Sept. 15, 2023, most US states will transition to higher Reid Vapor Pressure gasoline. Those autumn and winter specifications for gasoline enable gasoline blenders to load up finished motor fuel with cheap butane, naphtha and natural gasoline. The week of Sept. 11, 2023, has seen little selling tied to the imminent change in formulae. At the very least, some of the huge premia for reformulated gasoline should disappear in most markets, putting some downward pressure on gas prices.

Postscript: It’s not just refiners who have seen expanded largesse for profits in recent years. Gasoline retailers have also seen their fortunes improve.

Back in October 2007, the typical rack-to-retail gross margin was just 13.4cts/gal, with diesel margins a few pennies higher. Today’s average margin based on real-time data in OPIS MarginPro amounts to 34cts/gal for regular gasoline and 35cts/gal for diesel.