Panama Canal Bunkers Sales Slid Amid COVID-19, but Transitway Remains Key

Since the beginning of 2020, the world has been dramatically altered in the wake of the COVID-19 pandemic.

In the early stages of the world grappling with the virus, populations were asked to help limit the spread, which in part involved cutting back on public engagements and interactions. That pullback lead to a slowdown – and in some cases, a halt – to parts of the world economy such as service industries.

However, goods and products still had to flow. Shipping is one of the key links in the global dance of getting raw materials to processing centers and global products to consumers.

Shipping could not and has not stopped during the pandemic.

Shipping personnel and port workers continued to perform necessary work of loading cargo, moving ships in and out of the ports around the world in a safe manner. (In some cases, enduring hardships at seas, but that is a story for another time.)

Cargo at ports continued to flow. Ports such as Los Angeles saw record volumes of cargo in 2020 and continue to see record volumes in 2021 with no anticipated slowdown.

And that brings us to shipping lanes. For the Western Hemisphere, the Panama Canal is one of the world’s key shipping lanes, a sort of shipping highway connecting the Atlantic and Pacific oceans.

Built in the early 20th century, the waterway gives vessels the ability to cut thousands of miles off voyages and, as the canal’s operator has pointed out, helped the world reduce greenhouse gas emissions by 13 million tons of CO2 in 2020.

Sailing through the waterway involves a system of schedules, personnel, tugboats and trains. Some days it is smooth sailing (no pun intended). On others, vessel traffic can back up and cause delays.

Downtime at the canal allows ships the opportunity to load up on supplies and marine fuel, making it one of the key bunker hubs in the world. The area hosts large bunker storage facilities along the canal and nearby islands, where millions of barrels of petroleum products change hands every year.

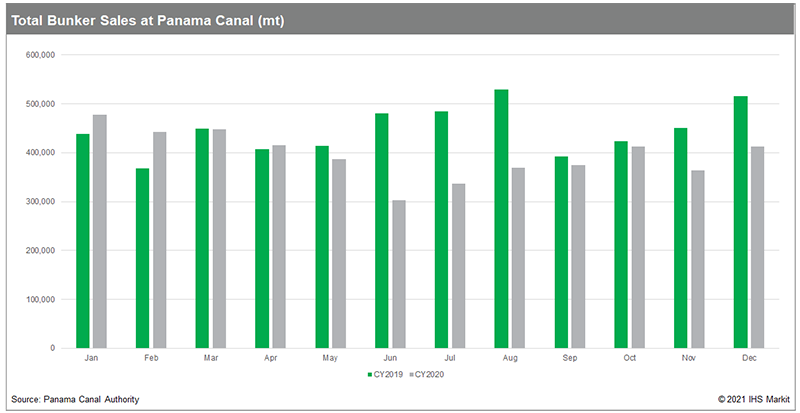

Last year saw bunker volumes dip slightly as the number of vessels transiting the canal during COVID-19 pulled back, although cargo tonnage has remained strong.

The Panama Canal Authority reported overall bunker sales in 2020 decreased a little more than 11% compared with those of the previous year. The top product sold was the new kid on the block: very-low-sulfur fuel oil (VLSFO). A total of 3.6 million metric tons of VLSFO were sold at the canal in 2020.

Despite that pullback in bunker sales, cargo tonnage increased to 255.8 million long tons in 2020 versus 253 million long tons in 2019. Tonnage moved through the canal in recent years has been on the rise due to increasing size of vessels that can safely make their way through the passageway.

Bunker companies have been battling for business in the region for years. And despite the pullback in bunker volumes during 2020 at the key waterway, companies were still making moves to strengthen positions at the hub.

Take recent moves by two of the world’s largest bunkering companies: Peninsula Petroleum and Monjasa.

Just this month, Peninsula Petroleum added to its Panama fleet by moving the Gibunker 100 tanker to Panama from Gibraltar. After sailing through the locks at the beginning of the week of April 25, the tanker had already performed a ship-to-ship bunkering operation April 29 on the Pacific side.

In March, Monjasa announced the move of its MT Monjasa Supplier tanker to Panama from Dubai. The tanker can operate in rough seas, the company noted, adding that it would be performing bunkering in the outer anchorage area of Panama on the Atlantic side. This week, though, the tanker could be seen performing bunkering operations on the Pacific side.

In April, Monjasa reported its 2020 business dealing in its annual report and noted a 9% increase in total volumes with Panama as its top supply area.

This year, the world may get a better picture of how bunkers and VLSFO will be a part of the market, or maybe even newer fuels, such as ammonia, hydrogen or LNG. But one thing is for certain: The Panama Canal will continue to be a key highway for the world and goods/materials that need to be moved, and the companies there will be ready to serve.

Listen to a roundtable discussion on the Panama bunker market recorded on May 18, 2021. Hear from experts at Peninsula Petroleum, BLUE Insight, and Vopak as they discuss bunker fuel demand and price recovery through Q1 2021 and what can be expected in the near-term. Watch it now!