IMO 2020 Fuel Regulations: The Impact on Refiners

A lot of energy industry press coverage in 2019 was devoted to something called “IMO 2020.”

For those who spent last year living under a rock, the U.N. body responsible for shipping passed a regulation stating that the world’s bunker fuel needs to drop from 3.5% sulfur to 0.5% sulfur starting in January 2020.

Well, guess what? It’s January 2020! So, what’s the IMO 2020 impact on refiners?

In our latest episode of the OPIS Crash Course podcast, Pat Hemsworth, Senior VP at Paragon Global Markets, and Denton Cinquegrana, chief oil analyst at OPIS talked IMO 2020 specifics at the refinery level, with an added focus on IMO 2020 price impacts.

Listen now:

Here are some quick takeaways from the episode.

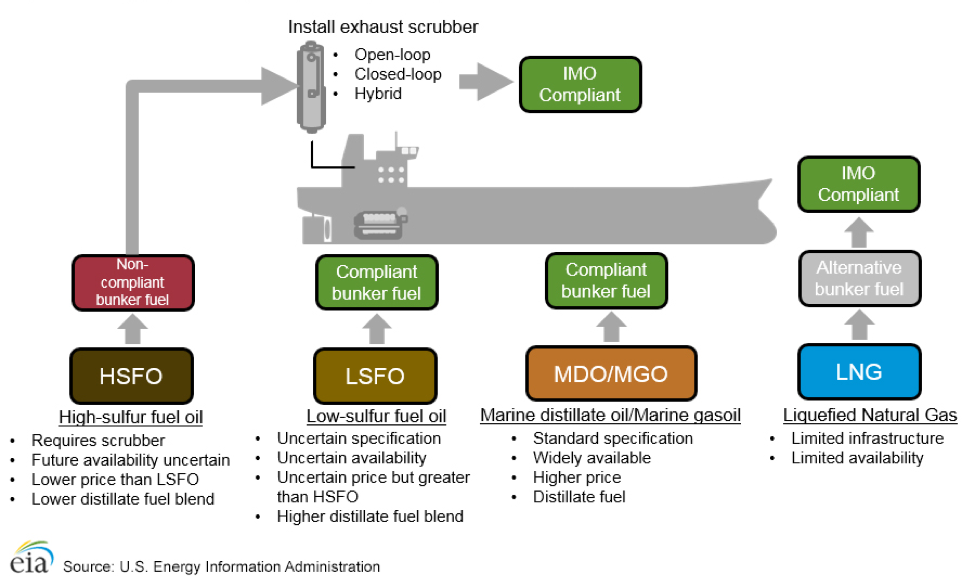

IMO 2020 Gives the Shipping Industry Several Choices

IMO 2020 compliance can be achieved by shippers via several options:

- Install scrubbers to remove sulfur from 3.5% High Sulfur Fuel Oil (HSFO)

- Consume Very Low Sulfur Fuel Oil (VLSFO), the 0.5% sulfur fuel

- Consume Marine Gasoil (MGO)/distillate

- For new vessels, consume LNG

Very Low Sulfur Fuel Oil Refining Specifics for IMO 2020

The refining process for this 0.5% sulfur fuel involves a discussion of refinery complexity and crude quality.

Refinery Complexity & IMO 2020 Explained

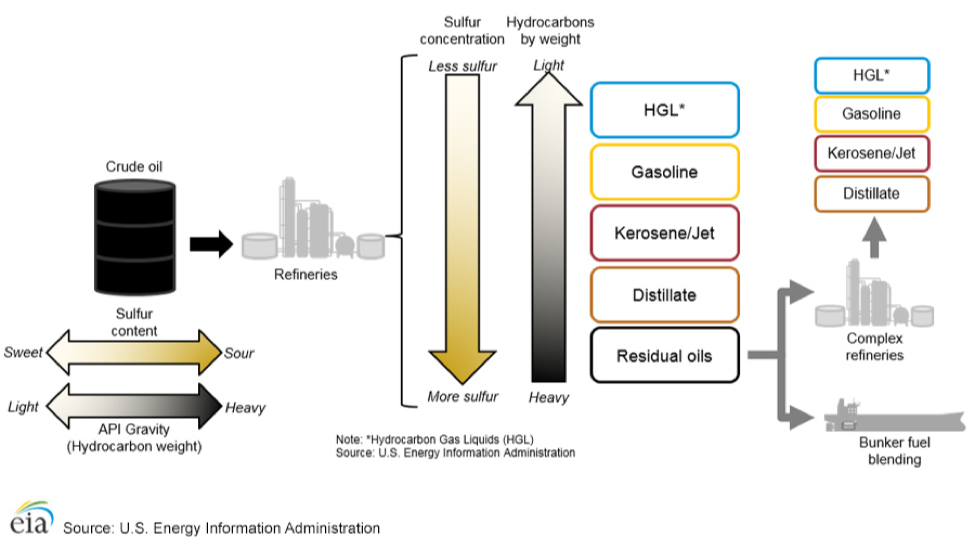

Refineries are differentiated by their capacities and the types of processing units used to produce petroleum products.

Basically speaking, refineries have a distillation column, which separates crude oil into different petroleum products based on differences in boiling points.

The simplest refineries have a distillation column and nothing else. By itself, the crude distillation column has low yields of high-value transportation fuel products.

Refiners may also have secondary unit operations. Each secondary processing unit after the distillation column has a specific purpose, whether it is upgrading low-value products (like residual fuel oil, to high-value products, (like distillate), increasing octane in gasoline or enhancing environmental compliance by removing sulfur and other pollutants.

Note: This is where IMO 2020 may impact gasoline supply. Should a refiner find more value in the marine fuel market for low-sulfur VGO, gasoline yields may get cut back.

Crude Quality & IMO 2020 Explained

In a simple refinery, the yield of products is determined by the kinds of crudes run.

In order to produce the optimal levels of low sulfur distillates a simple refinery with a simple topping unit would ideally buy heavy (low-API) sweet (low-sulfur) crudes, which will yield a high level of low- sulfur distillates.

More complex refiners were designed originally to be able to process the plentiful and very cheap heavy sour (high-sulfur) crudes and then employ operations to remove sulfur or reconfigure molecules to yield higher-value products.

Note: The United States has the advantage of very high complexity refineries, enabling it to have the most flexibility in the production of products. This stands to make U.S. refineries key in the IMO 2020 world.

But now comes the matter of crude quality.

Heavier crude, which yields the greatest amount of distillate, has been cut back worldwide as sanctions are re-imposed on Iran and Venezuela and Libya (other heavy producers) remain unpredictable.

The shale revolution in the United States has been a boon for U.S. industry and, as a result, the crude slate has gotten lighter, yielding less middle distillate.

In response to IMO 2020 and the lightening of the global crude slate, heavier crudes have flipped their normal price relationships to lighter crude.

IMO 2020 Price Impact as Seen in Key Market Spreads

As IMO 2020 loomed, market watchers in 2019 noted several takeaways in terms of the relationships between various crude grades and associated products. Those relationships are often referred to in the industry as “spreads.”

Some things seen in fuel prices as a result of IMO 2020:

Sharply strengthening prices for desirable distillate rich crudes versus lighter grades like WTI, indicating a gradual understanding in the market place that “crude quality matters.” There will be competition for optimal crude grades. The market as a whole will pay up for light, sweet grades, while sophisticated refiners will vie for heavy sour crudes. Refiners that invested capital to be able to turn the heavy sour crudes into usable products will be in the best position to take advantage.

A sharp widening of high sulfur fuel oil spreads to low sulfur. However, there has been opportunistic buying of cheap HSFO by sophisticated refiners (with cokers to produce middle distillates for shipping). Those complex refiners, again, have the advantage. Conversely, simple refiners, who will produce cheap HSFO as an inevitable product from their topping units, may be disadvantaged.

Very low U.S. middle distillate inventories. Amid already low inventories in the United States (especially PADD 1 after the shuttering of the Philadelphia Energy Solutions refinery), the market entered a period of very high refinery maintenance late summer and fall. This led to a spike in distillate “crack spreads,” or the price relationship between crude oil and an associated product.

As a wildcard in the market, should a Polar Vortex or a similar distillate-demand-drawing situation emerge in 2020, IMO 2020 could find itself as one spoke of a complex supply wheel that could lead to sharply higher prices.

Stay tuned for more! And check out our entire podcast on IMO 2020 impacts here.

Discover an Easy, Efficient Way to Learn About Oil Prices

Each episode of the OPIS Crash Course.answers key questions in the fuel market related to oil commodities. Our goal is to bring you and anyone on your team up to speed on the dynamic fuel price marketplace, drawing on 40+ years of OPIS expertise.

Find the OPIS Crash Course podcast free on: